A closer look at your Supreme foundation.

OPERATIONS, PRODUCTS & TECHNOLOGY.

PRODUCTS & PROGRAMS

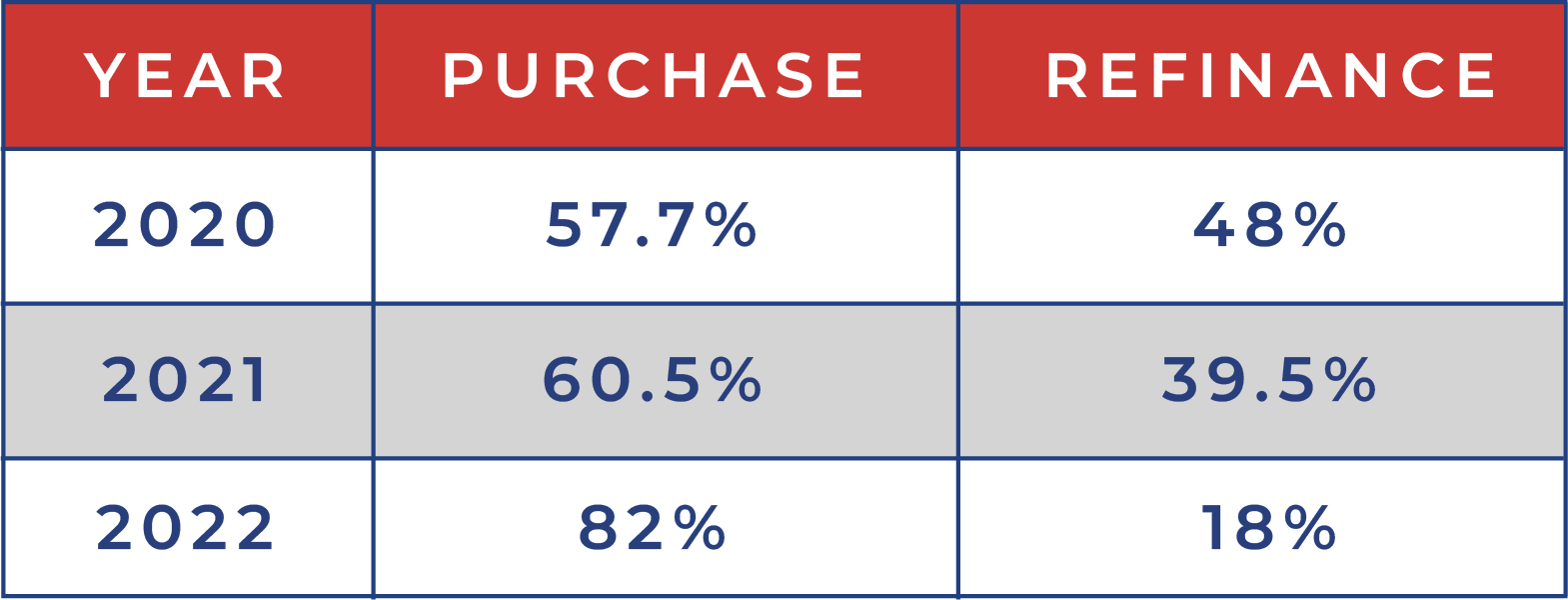

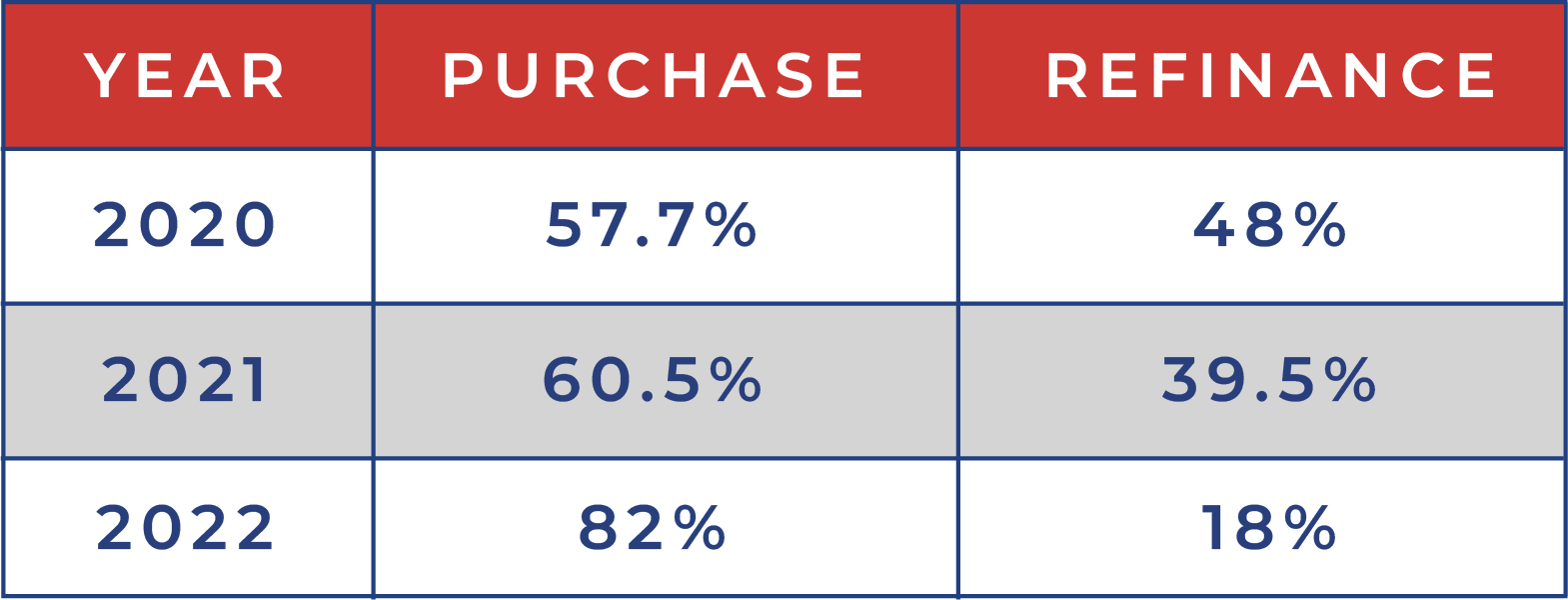

Loan Purpose

Product Mix

Supreme is focused on purchased business, which brings greater stability and predictability.

Supreme Lending is a Fannie, Freddie, and Ginnie Seller/Servicer. We also offer several non-conforming and specialty products to help meet just about any lending need.

Loan Purpose

Supreme is focused on purchased business, which brings greater stability and predictability.

Product Mix

Supreme Lending is a Fannie, Freddie, and Ginnie Seller/Servicer. We also offer several non-conforming and specialty products to help meet just about any lending need.

SUPREME LOAN PROGRAMS

Now, more than ever, your customers and referral partners need options.

TECHNOLOGY

Say hello to your new tech tool box.

Integrated technology that improves efficiencies, generates more leads AND enhances our customer experience.

OPERATIONS TEAM

This team has your back, and doesn’t hide behind email.

Average From App to Close in 2022

Families Served in 2022

%

Customer Satisfaction Rating in 2022

SERVICE & SUPPORT

Origination And Operations

Our top priority is making it easy for you to do business, and most importantly, succeed in your business.

Rate Assistance

- Scenario Desk and Deal Desk Teams available 7 a.m.–7 p.m.

- Calculate income and run loan scenarios

- Look and Lock™ program to lock a TBD file for 60 and 90 days

Lending Library

- Easy access to all Supreme guidelines and product information

- Policies and procedures

- Loan matrices, job aids, and worksheets

- Reference guides

- Broker resources

Program Finder

- Quick search for the best products

- Transparent pricing quotes

- Simple side-by-side loan comparison

Expert In-House Processing, Underwriting, Closing, and Funding Teams

- Dedicated teams to review and process Condo, Jumbo, and Renovation loans

- Delegated national processing for Bond loans

- Closing “911 Team” of specialized managers to resolve issues immediately

- Express funding through trusted partnerships with title companies

- 2-hour average Trust and Power of Attorney (POA) review

National Production Services (NPS)

- Fee-for-service options for loan origination, production support, set-up, and processing

- Interstate Lending Group portal

- Licensed in every state of Supreme’s footprint

APPLICATION TO CLEAR-TO-CLOSE

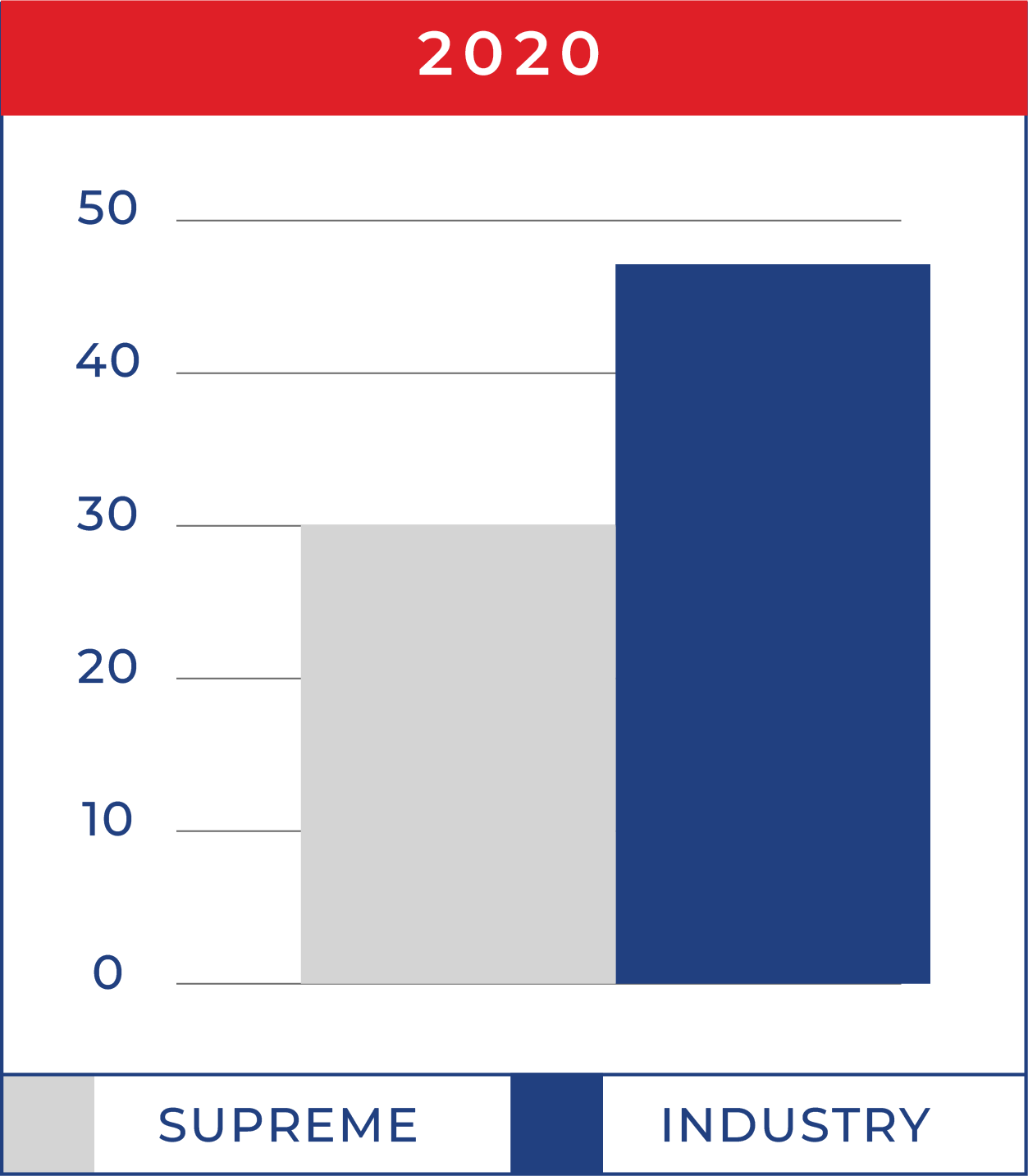

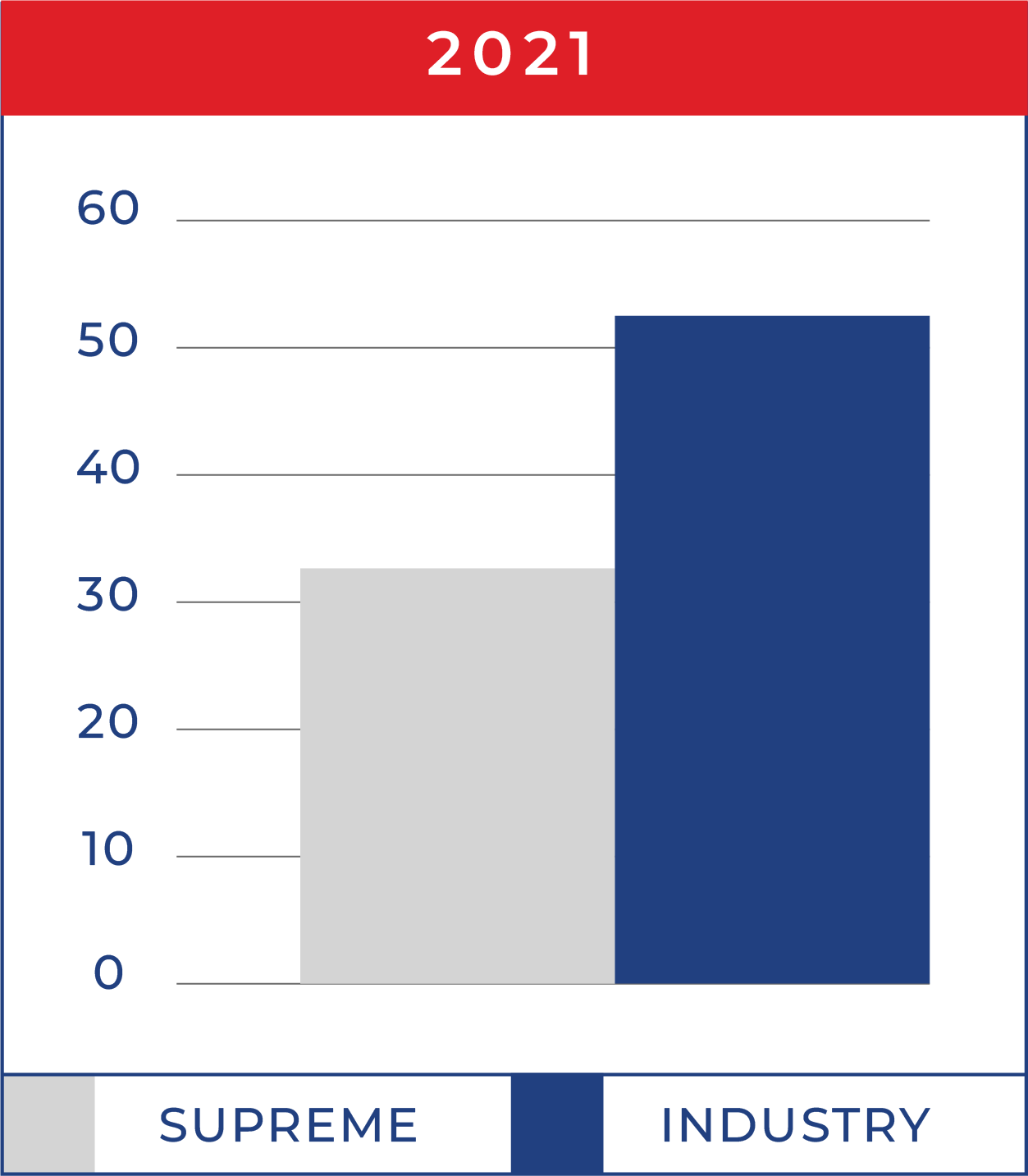

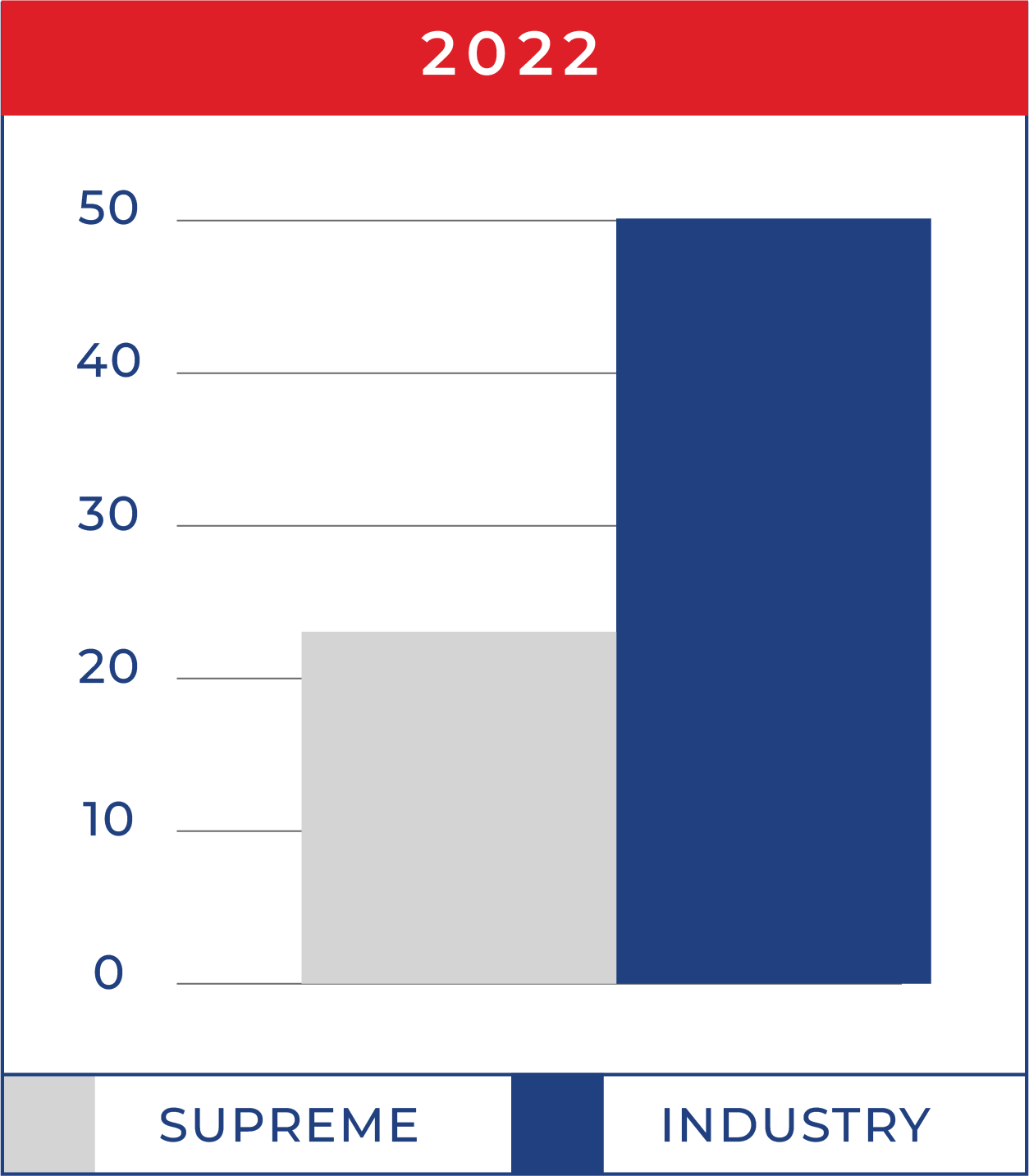

Supreme continues to outperform the industry when it comes to application-to-funding turn times.